Your Credit Score is Getting a Face-Lift: FICO Announces the Incorporation of ‘Buy Now Pay Later’ Into Credit Reporting

BNPL services, like Afterpay, Klarna, Affirm, and Sezzle, have exploded across checkout pages in recent years. With over 90 million Americans expected to use them in 2025, BNPL has offered convenience and become a financial force that is reshaping spending habits.

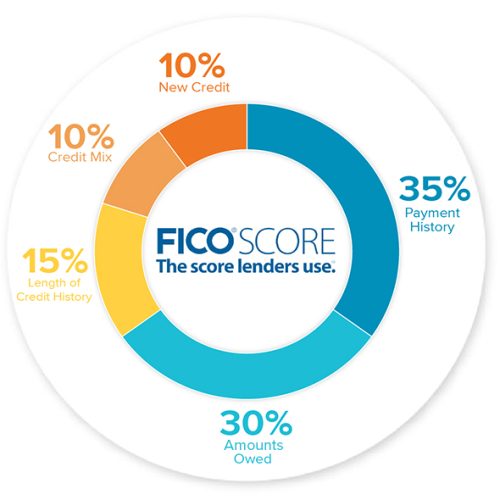

The major pivot for your credit scores: On-time and late payments will now be factored into standardized credit scoring models, starting this fall. This means that your BNPL history is no longer invisible, so it can inevitably help or hurt your credit score.

Why This Matters for Low to Middle-Income Consumers

First, BNPL carries the appeal and risks of easy access. According to the Fed, people with lower credit scores (620–659) are about three times more likely to use BNPL compared to those with scores above 720.

Many users are juggling multiple BNPL plans, buying essential purchases like groceries or utilities, sometimes without realizing the cumulative strain. BNPL can seem harmless because it is easy, often interest-free, and avoids the red tape of traditional credit.

How BNPL Reporting Shapes Your Credit Picture

You can build credit quicker with on-time payments. Studies have shown that including BNPL data can raise scores for disciplined users. Servicers like Affirm began reporting installment plans to Experian on April 1, 2025, and to TransUnion on May 1, 2025.

Also, like missed utilities or credit card bills, missed payments on BNPL will severely compromise individuals’ credit scores and creditworthiness.

2024 Late Payment Statistics: Late BNPL payments rose sharply, with almost 25% of serviced consumers being late and nearly 41% of users reporting at least one late payment in the last year, compared to 34% the previous year.

Real-World Scenarios for Thought

| Case | Income / Background | BNPL Usage & Result |

|---|---|---|

| Case A | $2,800/month, single mom, Denver | Uses BNPL for essential groceries & childcare items; if on-time, score is expected to rise from ~640 to 700 and unlock better loan terms. |

| Case B | Gig worker, inconsistent income | Missed 2 BNPL payments last month; with reporting, his credit score might dip 50+ points, costing him $100+ more monthly on loan interest charges. |

| Case C | 18–24 years, cash-strapped students | Highest BNPL use and first credit experience. Unaware that missed payments count. Credit score will likely dip to the poor range, creating future roadblocks for car purchases or home rentals after graduation. |

How to Turn BNPL into a Credit-Building Asset

With rising living costs and limited traditional credit access, low- and middle-income Americans increasingly rely on BNPL, so it is critical to understand and manage it wisely.

Our team at MyCreditAction is laser-focused on finding ways that you can turn everyday transactions into credit-building opportunities through our smart intelligent system that analyzes your complete financial profile – not just credit reports.

5 Essential Tips for Smart BNPL Management

The Bottom Line

Remember that the upcoming FICO model shift means your BNPL behavior now has reportable impact, both positive and negative. Responsible use can lead to faster credit growth, opening doors to lower interest rates, better loans, and even rental or job approvals.

On the other hand, misuse of BNPL can cause real credit damage with significant cost implications, lost opportunities, higher interest rates, and fewer future financial options.

Key Takeaway: You don’t need a big income to build strong credit, but you do need smart habits and guidance. This is where MyCreditAction’s intelligent analysis system comes in handy-always personalized, actionable, and accessible.

Ready to Transform Your Credit Journey?

Our smart intelligent system analyzes your complete financial profile holistically to provide personalized action plans that work for your unique situation.

Start Your Credit Analysis TodayJoin thousands who have taken control of their financial future with MyCreditAction.