Tax season isn’t just paperwork. It’s a yearly chance to crush debt, polish your payment record, and climb the credit-score ladder. Put these four moves in play before (and after) you file your taxes.

1. Put Your Refund to Work on High-Interest Balances

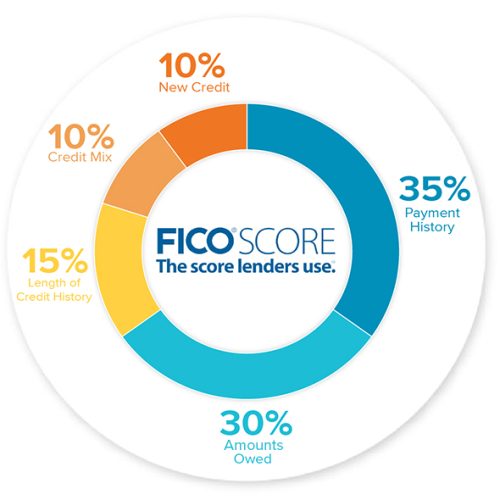

The average refund for the 2025 filing season was $3,116, according to the IRS. Paying even half of that toward a maxed-out card can drop your utilization below the critical 30 % line, and FICO® says utilization is roughly 30 % of your score. Stories like this U.S. News feature show consumers gaining 20 to 40 point boosts in a single billing cycle.

My Credit Action Tip: Our credit action tool reviews your credit profile in real time and delivers clear, personalized recommendations, such as which balances to pay down first or when to request a limit increase, so you can lower utilization and lift your credit score.

2. Owe Taxes? Plan—Don’t Panic

If the IRS says you owe, set up an IRS payment plan – it takes minutes online, doesn’t hit your credit report (Experian confirms), and usually costs less than floating the balance on a card. Need a walkthrough? See Investopedia’s Form 9465 guide. Budget the installments so other bills stay current, on-time payment history is the single biggest slice of FICO pie.

3. Pull and Polish Your Credit Reports

You can now grab free weekly reports from each bureau through 2026 (FTC announcement). Spot an error? File a dispute, the bureaus must respond within 30 days. Fixing even one mistaken late payment can restore dozens of points.

4. Keep the Momentum After filing your tax

- Start or top up an emergency fund so surprise bills don’t land on high-APR cards (Bankrate).

- Automate at least the minimum on every account to eliminate late-fee risk (NerdWallet).

- If you’re ahead of schedule, ask for a credit-limit increase or open a low-fee card; either move can lower utilization (Credit Karma).

Ready for a plan built around your numbers? Create a free account below, and our credit action tool will map out:

- Your personal utilization roadmap

- Credit improvement tips

- Our intelligent credit assistant can help craft dispute letters for any errors you flag

Get My Personalized Credit Roadmap

Tax season comes once a year-smart credit habits last a lifetime.